Multi-Regime Portfolio Optimization

Overview

- Identification of Current Regime

- MCMC simulated over a given period of time (e.g. one month)

- Expected Return of each asset

- Monte-Carlo simulation⇒VaR of any virtual portfolio (Gaussian mixture)

- Maximization of Expected Return / VaR

- Rebalancing based on dynamic criterion (profit taking) and/or signal strength

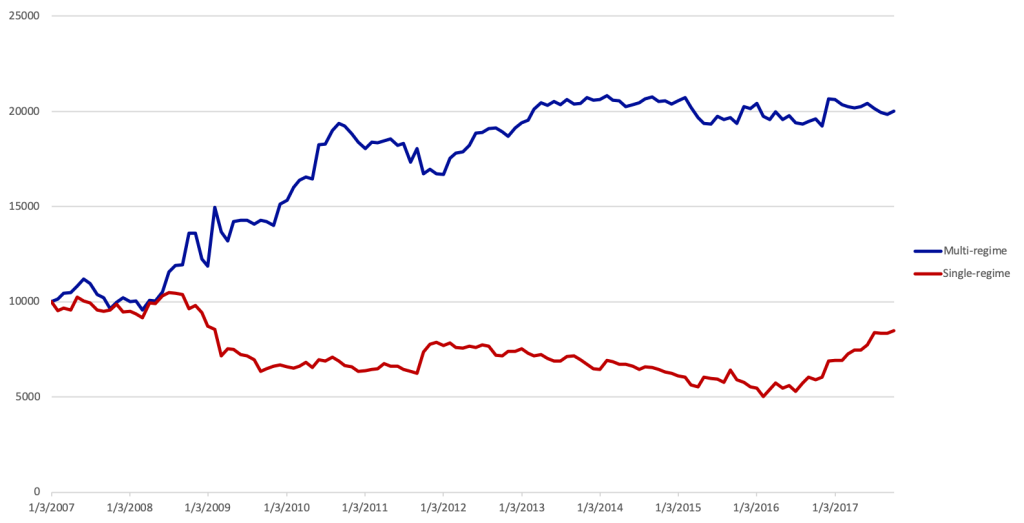

- Benchmark: Same with 1 regime = Markowitz

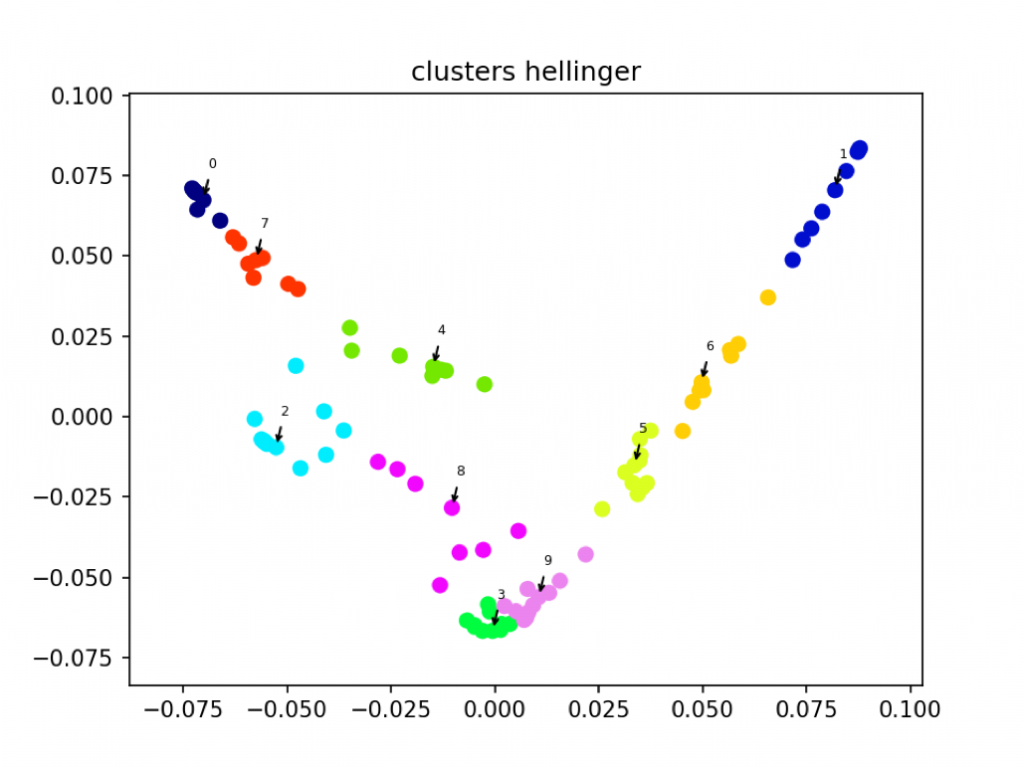

Spectral Embedding and Clustering

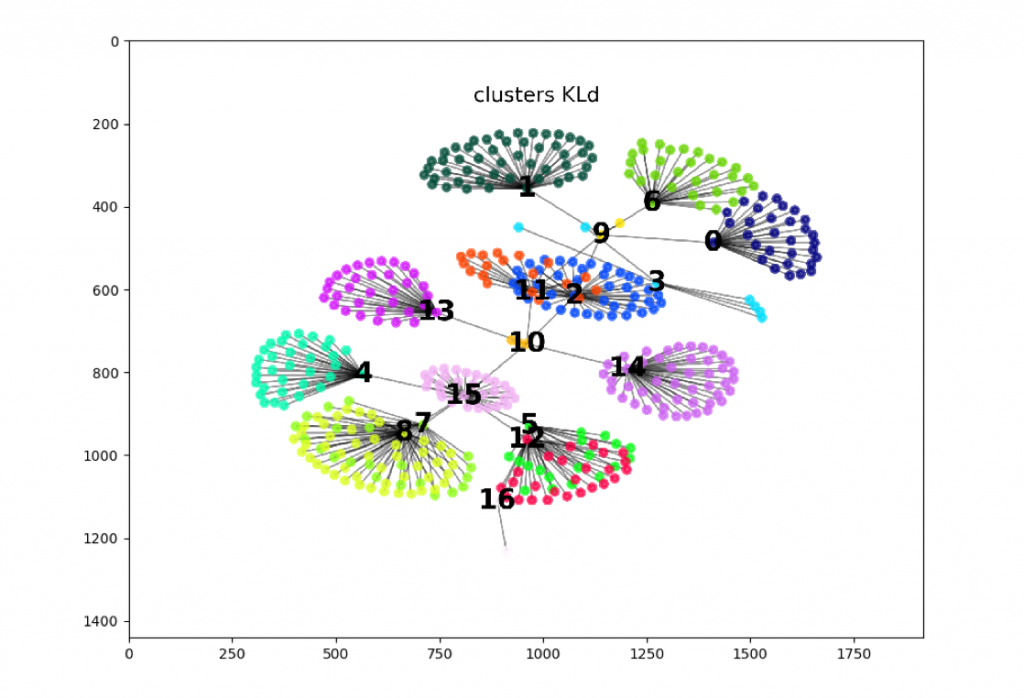

Clustering by Tree Algorithm

Regime Sequence

- Assume that Y1…Ym have mixed joint distribution

\(\ P = \pi_1P_1+…+\pi_qP_q\) with \(\pi_1>…>\pi_q\)

- Fat tails can be measured as the ratio of risk under P1 risk under other regimes.

- An optimizer that only accounts for some regimes will reduce the risk under those regimes, but increase the risk under other regimes, hence increasing fat-tailedness

⇒Regime changes have an aggravated impact on portfolio risk

Dynamics in the Market Variable Space

- Finite Number of Regimes R1,…,Rm

- Covariance Matrix Gk

- Drift Vector mk

- Rk ~ N(mk,Gk)

- Transition Probability Matrix

- P(t,t+1) = (phk)

- phk = Probability of transitioning from Rh to Rk

- ∀h, \(\Sigma^m_{k=1}p_{hk}=1\)

- P(t,t+n) = Pn

- Euler Scheme:

- Discretized Time t0,…,tn

- Pick new regime R(ti+1) according to P applied to current regime R(ti)

- Simulate Market Evolution following R(ti+1)

- Gaussian Mixture ⇒ “Fat Tails”

- Asymptotically Gaussian

- \(\mu_∞=\Sigma^m_{k=1}\pi_k\mu_k\)

- \(\Gamma_∞=\Sigma^m_{k=1}\pi_k\Gamma_k\)

- P’ \(\pi=\pi\), \(\pi=(\pi_1,…,\pi_m)\)

- Determine Breakpoints(\({t_1,…,t_n}\)) and “homogenous” periods \(J_k=[t_{k-1},t_k]\)

- Calibrate a Gaussian distribution\(N(\mu_k,\Gamma_k)\) over consecutive periods \(J_k\)

- Clusterize the set of \(\Phi=(\mu_k,\Gamma_k)\), using some information distance (K-L, Tsallis, Hellinger…)

- Issue: these distributions lie in a high dimensional space n(n + 3)/2⇒No recurrence

- Reduce dimension by describing the market with fewer indices

- Project \(\Phi_k\) onto a lower dimensional space, approximately preserving distances, using Spectral Embedding

- Common practice: focus only on volatility

- The projection now has some recurrence.

- Estimate Transition Probabilities

- Baum-Welch algorithm: too imprecise

- SVM or EM provide more accurate results

- Depends on time spent within a regime

- Crisis Prediction: Mild regime that is likely to transit to a wild one

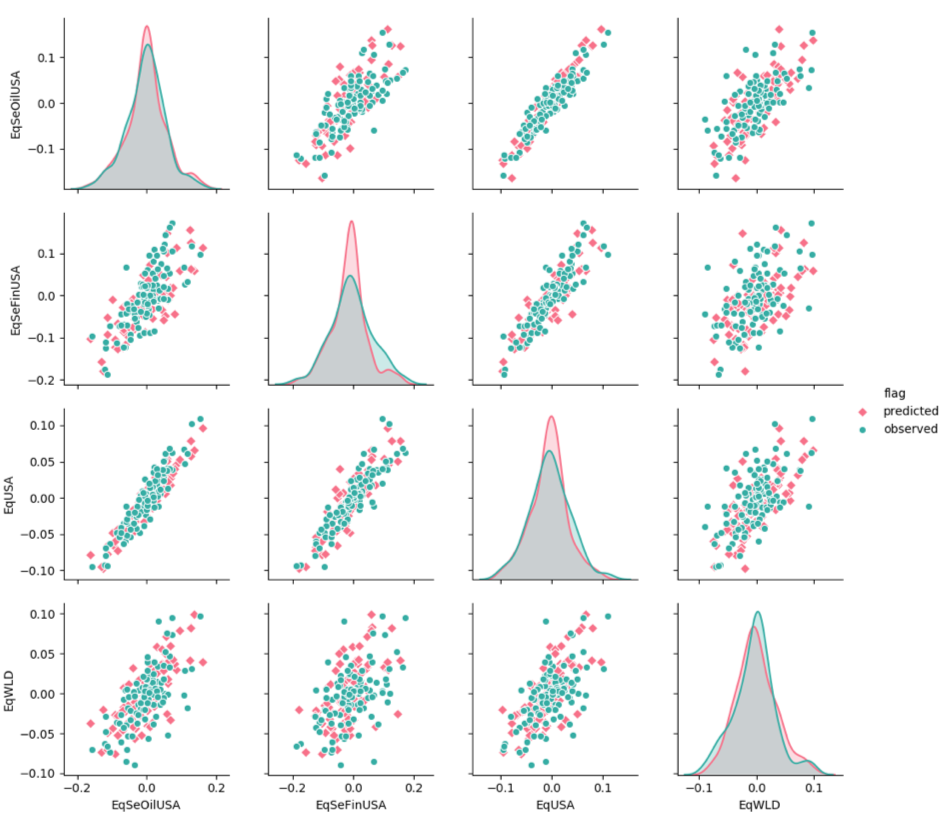

Multi-Regime Simulation vs. Observed

Pink: Multi-Guassian Simulation (MCMC)

Green: Actual Returns

Joint distribution of 4 risk factors:

SP500

SP Sector Financials

SP Sector Oil Companies

MSCI World

Simulation on US Market