Elliott Pairs Trading Model, 2005

$1,200.00

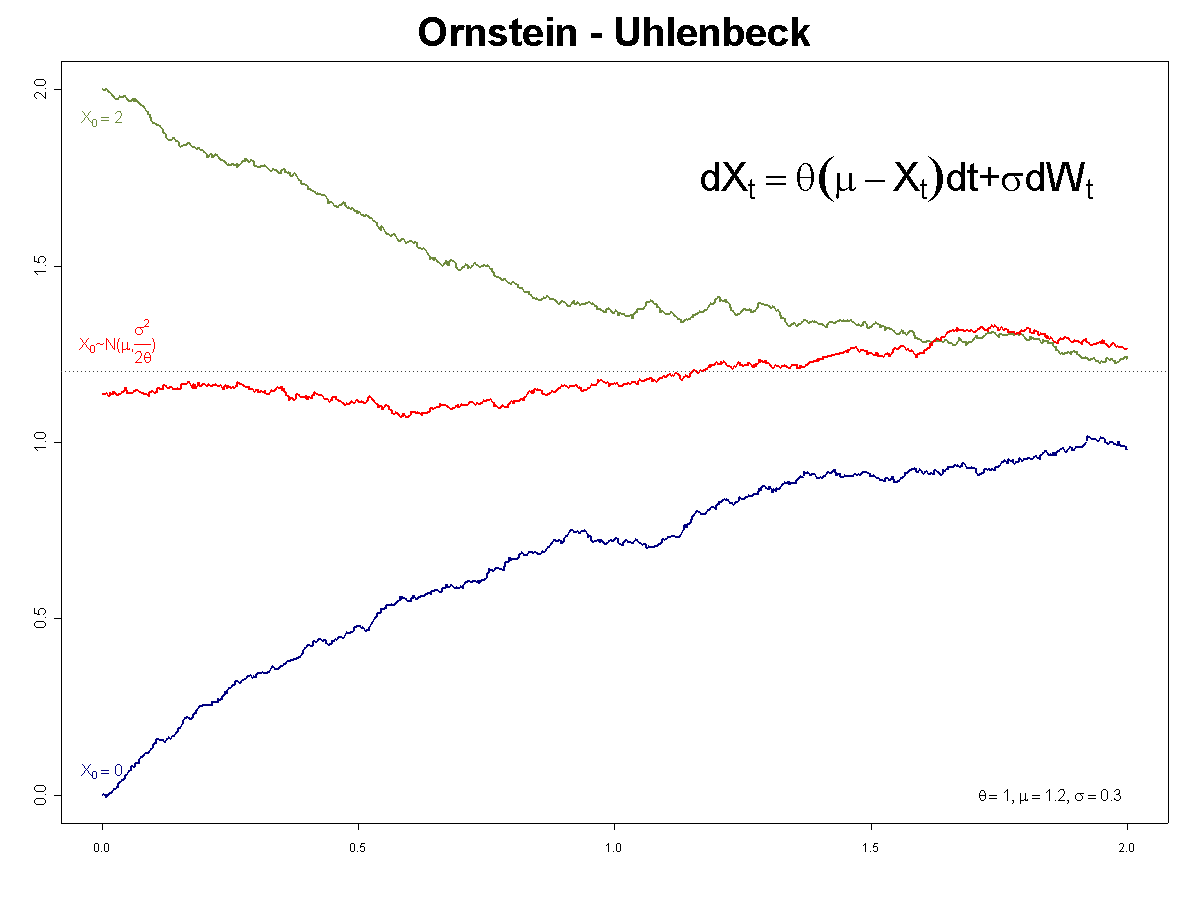

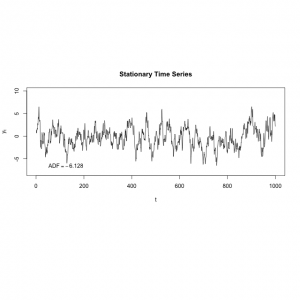

This paper models the spread of a pair (or any mean reverting synthetic asset) as a discrete Ornstein-Uhlenbeck (O-U) process. It then uses the Kalman filter to estimated the “true” (or hidden) price for the spread. When the observed price is bigger than the estimated true price by a threshold, we sell; otherwise we buy. The threshold and average holding time of a trade can be computed from the properties of the O-U process.

The paper describes two ways to estimate the parameters in the state process (for the spread):

Shumway and Stoffer (1982) smoother approach (offline)

Elliott and Krishnamurthy (1999) filter approach (online)

Notes

There seems to be some typos in the equations in the 2nd approach (the online algorithm) in the original publication.

References

http://www.tandfonline.com/doi/pdf/10.1080/14697680500149370

http://editorialexpress.com/cgi-bin/conference/download.cgi?db_name=QMF2004&paper_id=138

http://www-stat.wharton.upenn.edu/~steele/Courses/434/434Context/PairsTrading/PairsTrading.html

Code

http://redmine.numericalmethod.com/projects/public/repository/svn-algoquant/show/core/src/main/java/com/numericalmethod/algoquant/model/elliott2005

Reviews

There are no reviews yet.